Who is the Consumer?

Healthcare is a market where consumers have options. A consumer is any buyer of healthcare whether for themselves or their family or others they care for. Healthcare providers realize that they are often competing for patients and therefore must reach out to the consumers of healthcare in their catchment area and provide services in the form these consumers are interested in. Providers also realize that the expectations of healthcare consumers are changing and may depend on demographics, role or other factors.

Critical Issues

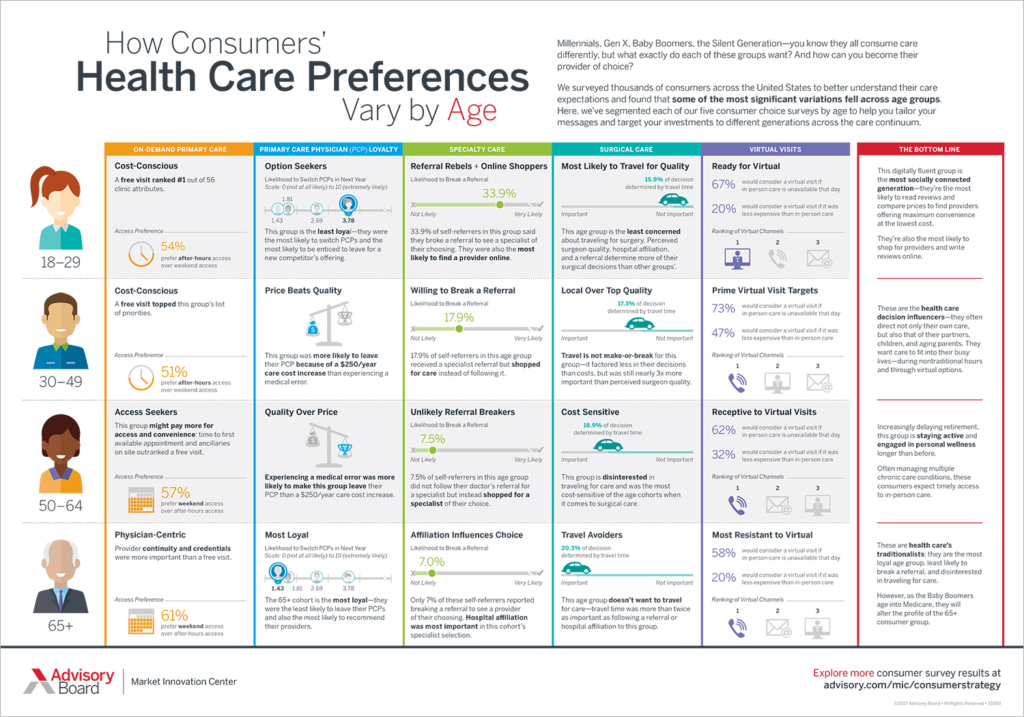

- Who is your target consumer? As any good marketing advisor will tell you. Target marketing is essential. Consumers in healthcare are not a homogeneous group. Each generation looks at healthcare, and how they want to access healthcare, differently. You should target service definition, promotion, incentives, etc. based on your target populations.

Consumer behavior patterns are changing. A consumer’s healthcare used to be centered around a long-term relationship with a primary care provider. Today consumers are researching on-line, selecting providers and buying healthcare services like they buy almost everything else. For example: Age groups 18-29 frequently do not have designated primary care providers and buy healthcare services as needed, based on their research and convenience. The loyalty of consumers to a given provider in ages 30-64 is falling. Price and quality considerations are rising as a method of selecting a provider. (7)

Deloitte (5), Beckers(6), and the Advisory Board(7) have all published informative studies on Health Consumer profiles to aid in targeting. Links to these articles are included in the Bibliography.

Note: Do not underestimate the capability of elders to use technology solutions. Many consumers age 70 and under have computer skills and have expectations about service technologies. Keep in mind that many of these people have experienced computers and remote services in some form for the past 40-50 years. (2)

-

- ATMs and video games became popular in the 1970s

- By the early 1980s, office jobs were beginning to center around computers and computer terminals.

- By the end of the 1980s, Microsoft applications were in everyday use in business.

- In the 1990s laptops were in regular use in business and were moving into the home. Amazon arrived in 1994,

- The iPhone arrived in 2007 followed by a deluge of Smart phones. The iPad arrived in 2010 and the over 55% of the early buyers were 55 or older.

- Consumer engagement – Don’t overestimate initial consumer acceptance. Common first year consumer engagement (prior to Covid 19) is less than 5%

- A major challenge and cost of implementing DTC is engaging consumers and getting consumers to use the services for the first time. As every DTC program has experienced, it’s not enough to tell them the service is available. You have to educate and promote its advantages to the consumer and address their potential resistance.

- The cost of promotion, consumer education, and incentives must be calculated into your budget.

- Change – Don’t underestimate the challenge of change. Although Consumers of DTC have reported very high satisfaction levels, this is a new service for them. Acceptance takes time.

- Provider Engagement:

- As DTC Providers – These are the clinicians providing the consultation over DTC. If you are using a provider panel from the DTC service provider, the need to engage your own providers is minimised but, to control cost and to improve provider utilization, it is essential to get your providers engaged and willing to provide consults through the DTC platform. This has been a challenge to date. However, the advent of Covid 19 is helping to change this in many cases.

You don’t need all your providers to participate. You only need a sufficient number to staff your anticipated demand (and you can use your service provider’s panel to fill in any gaps). You also want to make sure the providers you choose are comfortable, skilled and present well in a video encounter. This will require careful selection, onboarding, training and observation. Look for clinical environments in your system where providers are underutilized (urgent care centers are often a good place to look if you have them)

-

- As DTC Promoters – Providers are the best promoters. Ask your providers to tell patients about the service and encourage them to use it.

- Change – don’t underestimate the challenge of change

- Ease of use

-

- Provider – It is critical that the DTC fits within an effective and efficient workflow for the provider. Posting availability, scheduling, initiating the call and taking notes into the EMR are all critical and should be easy to use for the provider. The more you can imbed this process into your current EMR (initiate the call and document the encounter inside the EMR) the better. Make the place to take the call as convenient as possible. Their own office is usually the best (take time to make sure the location looks professional on video)

- Consumer – It is critical that the consumer user experience be easy and satisfying. For the young user, downloading an APP or accessing the service over the Web is generally common and easy. This becomes more complicated with age and demographic. Call connection reliability is also critical. Consumers will quickly become frustrated if the calls do not connect or are disconnected during the call. Test in your environment.

- Infrastructure – Connectivity and Devices – Make sure the solution you choose works within the connectivity limitations of your target consumer (bandwidth, Internet connectivity, cellular connectivity, etc.). It is preferred that no special device be required. The application should operate effectively with the devices commonly available and in-use in your target market.

- Integration with the consumer’s medical record/information access – The consumer should be allowed access to current status, results, notes, etc. either directly through a patient portal or through some of the mobile health platforms.

- Pricing – The common price to the consumer for a DTC primary care consultation ranges for about $49-$59 for a primary care/urgent care consult. Prices for behavioral health and other specialty consults appear to range from $59-$99 (at the time of this study)

- Portability – Consumers want healthcare where and when they need it. They are more mobile than before both physically and in the decisions to buy services. But they also want their medical information to go with them and be shared between providers. Markets like electronic banking, Amazon and most consumer buying sites have conditioned consumers to these expectations. (Consumers are able to make transactions from wherever they are, and their transactions, updated data and even preferences follow them wherever they go.)